Cost-Effective

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

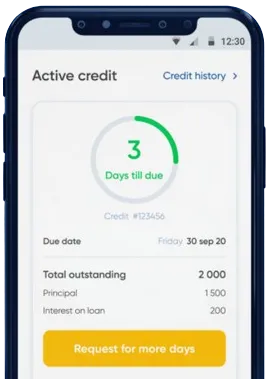

Quick and simple, without the hassle. Instant fund transfers with extended loan options

Enter your application details in the app by filling out the form.

Allow 15 minutes for our decision-making process.

Collect your money, with transactions often completed in one minute.

Enter your application details in the app by filling out the form.

Download loan app

In Nigeria, payday loans have become a popular financial instrument for individuals in need of quick access to cash. These short-term loans are typically granted without the need for collateral and are repaid by the borrower's next payday. The ease and convenience of obtaining payday loans have made them a valuable resource for many Nigerians facing unexpected financial challenges.

One of the key benefits of payday loans is their quick approval process. Unlike traditional bank loans that may take weeks to process, payday loans in Nigeria can be approved within a matter of hours. This makes them ideal for individuals who need immediate access to funds for emergencies or essential expenses.

Additionally, payday loans are accessible to individuals with poor credit history, making them a viable option for those who may not qualify for traditional bank loans. The flexibility of repayment options further enhances the appeal of payday loans, allowing borrowers to choose a repayment schedule that aligns with their financial situation.

Payday loans in Nigeria are commonly used to cover unexpected expenses such as medical bills, car repairs, or utility bills. These loans can provide a much-needed financial lifeline to individuals facing temporary cash flow challenges, ensuring that they can meet their financial obligations without disrupting their daily lives.

Furthermore, payday loans can also be used to bridge the gap between paychecks, helping individuals manage their expenses until their next payday. This can be particularly helpful for individuals who are waiting for their salary but need immediate funds to address pressing financial needs.

Overall, the usefulness of payday loans lies in their ability to provide quick and easy access to cash, allowing borrowers to address financial emergencies or temporary cash flow challenges without significant delays.

While payday loans offer several benefits and can be a valuable financial tool, it is essential to carefully consider the terms and conditions of the loan before taking one. Borrowers should assess their ability to repay the loan within the specified timeframe and evaluate the total cost of borrowing to ensure that they can afford the loan.

By taking these considerations into account, borrowers can make informed decisions about taking a payday loan and ensure that they can effectively manage their financial obligations without falling into a cycle of debt.

Payday loans in Nigeria offer individuals a practical and convenient solution for accessing quick cash in times of need. With their quick approval process, flexible repayment options, and accessibility to individuals with poor credit history, payday loans have become a valuable resource for many Nigerians facing financial challenges. However, it is important for borrowers to carefully consider the terms and conditions of the loan and assess their ability to repay it to ensure a positive borrowing experience.

A payday loan is a short-term loan that is typically repaid on the borrower's next payday. It is often used by individuals who need quick cash to cover unexpected expenses or emergencies.

In Nigeria, individuals can apply for a payday loan through various online platforms or lending institutions. The borrower typically provides proof of income and a bank account, and if approved, receives the loan amount in their account within a short period.

Eligibility requirements for a payday loan in Nigeria may vary depending on the lender, but generally, borrowers must be Nigerian citizens or residents, have a regular source of income, and be at least 18 years old. Some lenders may also require a certain credit score or employment history.

Fees and interest rates for payday loans in Nigeria can vary widely among lenders. It is important for borrowers to carefully review the terms and conditions of the loan agreement to understand the total cost of borrowing.

While payday loans can provide quick access to cash, they also come with high interest rates and fees. It is important for borrowers to borrow responsibly and only take out a loan if they are confident they can repay it on time. Borrowers should also be wary of predatory lenders and ensure they are borrowing from a reputable institution.

Defaulting on a payday loan in Nigeria can result in additional fees, a negative impact on the borrower's credit score, and legal action from the lender. It is important for borrowers to communicate with their lender if they are experiencing difficulty repaying the loan to explore alternative repayment options.